ezCater Orders and Sales Tax

New laws in many states affect how we pay catering partners.

They’re called marketplace facilitator laws, and they shift the responsibility for paying sales tax from individual sellers (like you) to the marketplace that facilitates the sale (like us).

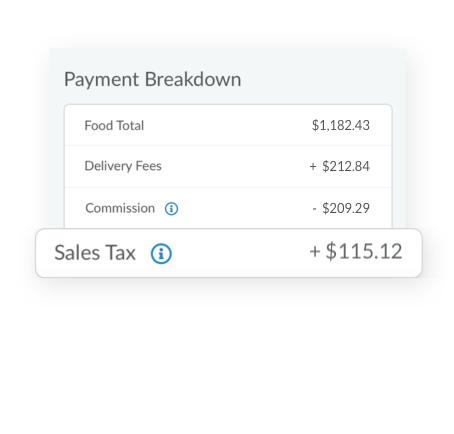

In states where these laws don’t apply to us:

Payments ezCater makes to you include all tax collected. It’s your job to pay all tax to the appropriate tax authorities.

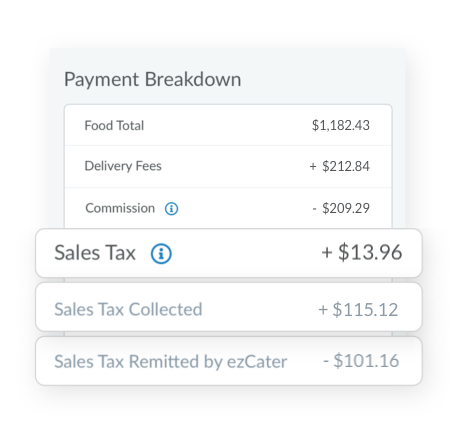

In states where these laws do apply to us:

Payments ezCater makes to you exclude tax that we must pay directly to state tax authorities.

If there’s any tax we don’t pay directly, our payments to you include it. It’s your job to pay this tax (usually local tax) to the appropriate tax authorities.

In this example:

$115.12 collected by us from people ordering catering

− $101.16 paid by us to state tax authorities (this is what’s new)

= $13.96 paid by us to you, for remittance like you always have done

State-by-state details (last updated July 1, 2024)

Taxes listed here are the taxes we pay directly to tax authorities.

This list is specific to ezCater. Some states have marketplace facilitator laws that don’t apply to us.

Any other taxes we collect are included in payments to you.

| State | Taxes ezCater pays to tax authorities |

|---|---|

| Alabama | Simplified Sellers Use Tax (SSUT) ezCater collects the simplified sellers use tax on sales to Alabama customers and remits the tax on behalf of Alabama customers to the Alabama Department of Revenue. ezCater’s program account number is SSU-R010733612. |

| Alaska | None |

| Arizona | None |

| Arkansas (Updated 4/1/2023) | State sales tax • State-administered local sales tax |

| California | None |

| Colorado (Effective 7/1/2024*) | State and local* sales tax • CO Retail Delivery Fee |

| Connecticut | State sales tax • State-administered meals tax |

| Delaware | None |

| District of Columbia | State-administered meals tax |

| Florida | None |

| Georgia | State sales tax • State-administered local sales tax |

| Hawaii | State sales tax • State-administered local sales tax |

| Idaho | State sales tax • State-administered local sales tax |

| Illinois (Updated 4/1/2023) | State sales tax • State-administered local sales tax • Chicago Restaurant • MPEA Food and Beverage Tax |

| Indiana | State sales tax |

| Iowa | State sales tax • State-administered local sales tax |

| Kansas | None |

| Kentucky | State sales tax • State-administered local sales tax |

| Louisiana | None |

| Maine | State-administered meals tax |

| Maryland | State sales tax • State-administered local sales tax |

| Massachusetts (effective 4/1/2022) | None |

| Michigan | State sales tax • State-administered local sales tax |

| Minnesota (effective 9/1/2021) | State sales tax • State-administered local sales tax |

| Mississippi | None |

| Missouri | None |

| Montana | None |

| Nebraska | State sales tax • State-administered local sales tax |

| Nevada | State sales tax • State-administered local sales tax |

| New Hampshire | None |

| New Jersey | State sales tax • State-administered local sales tax |

| New Mexico | State sales tax • State-administered local sales tax |

| New York | None |

| North Carolina | State sales tax • State-administered local sales tax |

| North Dakota | State sales tax • State-administered local sales tax |

| Ohio | State sales tax • State-administered local sales tax |

| Oklahoma | State sales tax • State-administered local sales tax |

| Oregon | None |

| Pennsylvania | State sales tax • State-administered local sales tax |

| Rhode Island | State sales tax • State-administered meals tax |

| South Carolina | State sales tax • State-administered local sales tax |

| South Dakota | None |

| Tennessee | None |

| Texas | None |

| Utah | None |

| Vermont | State-administered local sales tax • State-administered meals tax |

| Virginia | None |

| Washington | State sales tax • State-administered local sales tax |

| West Virginia | State sales tax • State-administered local sales tax |

| Wisconsin | State sales tax |

| Wyoming | State sales tax • State-administered local sales tax |

Here’s what hasn’t changed.

The customer experience is the same. They pay the same tax as always.

Tax-exempt orders are the same. Because there’s no tax!

Orders we don’t process payment for are the same. Some catering partners add in-store orders to ezManage and process payment through their own POS.

We can’t give tax or legal advice.

Please contact your lawyer, accountant, or taxing authority for that.

For everything else, we’re here to help.

Tax laws change. We update things accordingly so that the right tax gets to the right place.

If you have questions about the tax on an order, please contact us within 30 days of the order.